The final rules on Section 501r were issued on December 29, 2014. It was encouraging that Treasury took time to consider feedback through the prior commentary periods and used that feedback constructively to craft the final rules.

The overall objectives of the regulations are to require that a hospital’s financial assistance policy (FAP) and Community Health Needs Assessment (CHNA) are clear and concise while providing protections for patients who are eligible for financial assistance. It is very evident that hospitals will become increasingly accountable for the clear and consistent deployment of financial assistance policies and objectives.

When should you address these changes?

You have no doubt seen the news stories focused on the billing and collection practices of non-profit hospitals. A recent story described a hospital’s third party vendors sending collection letters prematurely to patients. Another comprehensive analysis of hospital practices alleged that a non-profit hospital pursued wage garnishments against thousands of low income community residents in their community. After US Senator Charles Grassley saw that particular story, he expressed concern that some non-profit hospitals may not be operating in a manner consistent with federal rules.

Mark Rukavina from Community Health Advisors is a leading authority on FAP and CHNA policy and procedure. He recently investigated whether hospitals are being transparent regarding financial assistance policies. After reviewing more than a dozen large non-profit hospitals and hospital systems selected at random, he reported that only one in five made the actual policies available on websites and most did not adequately describe eligibility criteria or the details of assistance provided through their policies.

The final rule takes effect for fiscal years beginning after December 29, 2015. Most hospitals believe that they can wait until then to comply. The preamble to the final rules clearly states that hospitals may rely on a reasonable, good faith interpretation of the statue for early years (and, yes, that means now). According to Rukavina, “It is a puzzling why a hospital would delay deploying these requirements given the extra scrutiny non-profit hospitals are experiencing. Leading hospitals should be quick to adopt the new requirements and widely publicize them in their communities.”

I would suspect that most hospitals presently comply in many aspects but they just have not been formalized or incorporated into their policies or adequately publicized.

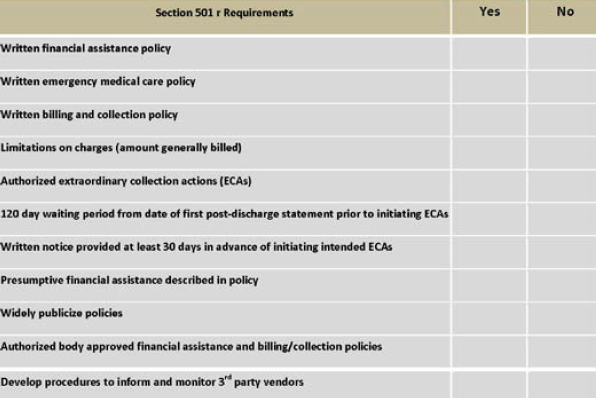

Start with a checklist:

Rukavina recently developed a starting checklist for PARO clients to use to help organize their thoughts around updating their policies and procedures. By completing this checklist, you can quickly glean what needs to be improved and then set priorities to bring your FAP up to standards.

Here are some summary highlights of changes that require attention:

Presumptive Screening

PARO has been providing presumptive charity screening tools for hospital for nearly 10 years. In 2014, we identify nearly 3 million patient visits that qualified for free or discounted care. The final regulations go a long way in supporting the utilization of presumptive charity for electronic screening of patients.

The net results will be the simplification of charity distribution from hospitals and the removal of application barriers for the poor and illiterate. There are some requirements for patient notification of eligibility. In particular, if using presumptive eligibility for a discount less than free care or your most generous level of assistance, these patients must be informed of the discount they have received, as well as the method of applying for a more substantial discount. There are also requirements that your FAP describes the presumptive eligibility methods that are being utilized.

The key to utilizing an analytic to determine charity care is that the policy must reflect that a tool is being used and that must be applied consistently for patients. The other crucial element is a change in your FAP to describe what constitutes documentation of indigent status under your FAP.

Application Period

Please note that the application period for a patient to apply for assistance extends 240 days after the date of the first post-discharge statement. This period is irrespective of bad debt assignment. This means that you must make your FAP available to all patients during this period. In the event that you have followed the notification process for assignment to bad debt at 120 days, your agency would be required to follow your same FAP process for an additional 120 days.

More than ever before, it is important to make sure that all your vendor-partners understand and also deploy your FAP during their work flow process. The rules have some degree of complexity for refund of payments made during an application period and other related provisions, so be sure to fully understand these requirements.

Summary

As with any new rules, now is the time to act. The media’s level of engagement and the additional scrutiny for consumer rights really make this an issue for today. The rules are available, well organized, and hospitals have every advantage to gain from deploying sooner than later.

Neil Smithson is the founder of PARO Decision Support, LLC. PARO provides charity screening and predictive analytics to hospitals nationwide. He can be reached at nsmithson@paroscore.com Table provided courtesy of Community Health Advisors. All Rights Reserved 2015. www.communityhealthadvisors.com mark@communityhealthadvisors.com

About State Collection Service, Inc.

Since 1949, State Collection Service has provided quality collection service to countless healthcare organizations.

Through experience and innovation, State Collection Service has grown to become a tremendously credible and nationally-recognized collection agency offering services from pre-registration to bad debt. It is upon the basis of ethical behavior and a dedication to integrity that each State Collection Service employee works to uphold the company’s vision – Partnerships for a Lifetime.

*This article first appeared in “A State Collection Service, Inc. Newsletter Volume 21, Issue 1, First Quarter 2015”