Healthcare Politics in the Post-Election Environment

The 2014 mid-term elections are behind us. Some believe that Republican control of Congress means there will be revisions made to the Affordable Care Act (ACA). The most vocal opponents of the ACA believe that repeal is possible. But repeal is out of the question, at least for the final two years of President Obama’s term.

Over the next few years, millions of uninsured Americans will gain coverage. This will make repeal of the ACA even less likely. However, politics will determine whether certain elements of the ACA will be revised. Predicting the future is never easy or certain. But understanding how some requirements of the ACA came to be, helps one assess whether particular provisions of the ACA are in jeopardy under a Republican Congress.

Requirements for Federal Tax Exemption

Including in the ACA was Section 9007. It directed the Internal Revenue Service (IRS) to establish Section 501r of the Internal Revenue Code putting new requirements on hospitals in order for them to maintain tax-exempt status.

The architect of these provisions was Republican Senator Charles Grassley (IA). He has been investigating the pricing, billing and collection practices of non-profit hospitals since 2004. In 2005, he asked selected non-profit hospitals for information on their charitable activities to better understand the community benefit provided in exchange for the federal tax exemption.

The content of a press release issued by Sen Grassley’s office in April of this year summarizes his concerns and rationale for insisting that these new provisions be included in the ACA.

Grassley’s reforms came after oversight and investigative reviews of nonprofit hospitals revealed troubling practices among some nonprofit hospitals, including providing very little charitable patient care or other community benefits; failing to publicize charitable care to patients; charging indigent, uninsured patients more than insured patients; and using very aggressive collection practices. The Government Accountability Office and others, including the former IRS commissioner, have said for a long time that there is often no discernible difference between the operations of taxable and tax-exempt

Earlier this year, Sen. Grassley requested that the IRS provide an update on the status of a report on the Section 501r provisions that was to have been issued during fiscal year 2012. Given Sen. Grassley’s longstanding interest in the issue of community benefit activities of non-profit hospitals, it appears that the Section 501r provisions will remain in place irrespective of which party controls Congress.

Under Section 501r, hospitals must comply with these requirements and should have conducted at least one community needs assessment and have in place transparent, defensible policies regarding financial assistance (FA), billing/collection, and limitations on charges for FA-eligible patients. As the ACA was passed more than four years ago, non-conforming hospitals run the risk of being scrutinized by regulators and jeopardizing their federal charitable status.

Although final regulations have not yet been issued, the ACA was passed in March of 2010 and hospitals should be able to clearly demonstrate that they meet these requirements. It is the expectation of consumer advocacy organizations that the information required under Section 501r be readily available. And they are watching. This was illustrated in August when two legal service organizations filed a complaint with the IRS and HHS, alleging Jackson Health System failed to meet these requirements. The complaint claims Jackson did not widely publicize its charity care program, subjected uninsured patients to harsh debt collection practices without informing them of available financial assistance, and did not adequately conduct a community health needs assessment.

Publicizing Information

The Affordable Care Act clearly states that the needs assessment must be made widely available to the public and that the above policies must be widely publicized within the community served by the hospital.

The proposed regulations call on hospitals to widely publicize information on their community needs assessments and financial assistance policies and set minimum standards for doing so. The financial assistance policy, as application form and a plain language summary are to be available free of charge. This information, and the assessment, should be posted on the hospital (or health system) website and available in hard copy upon request, free of charge. It is also expected that information on the availability of financial assistance be conspicuously posted in public locations throughout the hospital.

Financial assistance information should also be available in languages other than English if the primary language spoken by limited English proficient populations constitutes more than 10% of the population in the hospital service area. Hospitals are also expected to ensure that they have taken measures to inform community members in need of assistance of their policies.

How Transparent are Hospitals Regarding Section 501r Requirements?

As part of Community Health Advisor’s ongoing work related to Section 501r, we recently investigated a random sample of non-profit hospitals for compliance with its requirements. We reviewed hospital websites for information on community needs and assessments and financial assistance policies.

The findings from this investigation were surprising, especially given the industry and media attention focused on Section 501r over the past four years.

- The vast majority (87%) of hospital websites provided access to the most recently conducted Community Health Needs Assessment.

- While 87% of hospitals made reference to help being available if patients had questions on their bills or needed assistance, it was not always clear that the hospital was offering financial assistance for these bills.

- Fewer than half (47%) of the hospitals included links to their financial assistance applications.

- Two in five (40%) hospitals included summaries of their financial assistance policies.

- Only 20% of hospitals included their actual financial assistance policy on their website.

Section 501r Compliance

The Section 501r provisions were intended to improve transparency and accountability regarding community benefit activities. The results above raise concerns about whether all non-profit hospitals are complying with the statutory language regarding the measures to be taken to widely publicizing this information.

There is no doubt that hospitals should have formal, written financial assistance and billing/collection policies in place today and that these policies should be made readily available. Hospitals should also have conducted at least one Community Health Needs Assessment and have developed an Implementation Strategy based on the assessment. The bottom line is this – hospitals interested in maintaining these tax-exempt status under federal law must comply with Section 501r requirements.

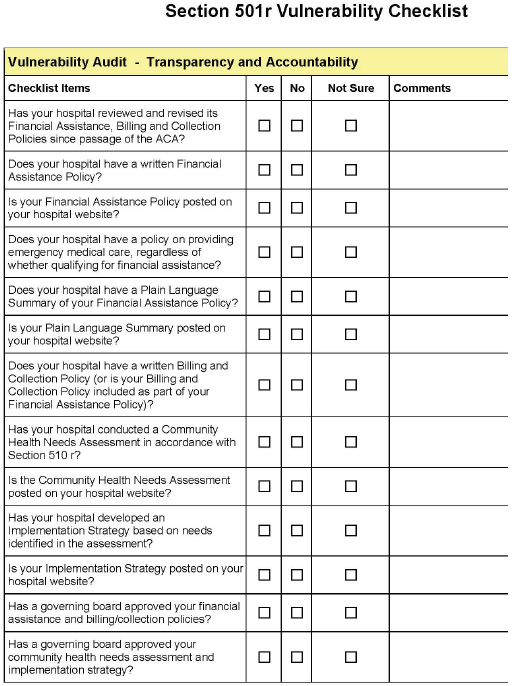

Community Health Advisors has developed a simple checklist to assist you in assessing whether your policies and practices put your federal tax exemption at risk…. If you answer no to four or more questions, you may come under the scrutiny of policymakers or the general public.

In this case, you may want to consider engaging an expert to review your assessment, implementation strategy and your financial assistance and billing/collection policies to ensure that they comply with Section 501r requirements. Community Health Advisors offer hospitals an expert, external review and provides them with feedback on policies and practices. Such feedback could be critical to ensure that policies and practices are clear, defensible, and that they comply with the requirements of Section 501r.

Regardless of how your review is conducted, it is crucial for your hospital to have formal policies that comply with these federal requirements. The federal tax-exemption for your hospital, one of your most valued assets, depends on it.

How Transparent are Hospitals Regarding Section 501r Requirements?

As part of Community Health Advisors’ ongoing work related to Section 501r, we recently investigated a random sample of non-profit hospitals for compliance with its requirements. We reviewed hospital websites for information on community needs assessments and financial assistance policies.

The findings from this investigation were surprising, especially given the industry and media attention focused on Section 501r over the past four years.

- The vast majority (87%) of hospital websites provided access to the most recently conducted Community Health Needs Assessment.

- While 87% of hospitals made reference to help being available if patients had questions on their bills or needed assistance, it was not always clear that the hospital was offering financial assistance for these bills.

- Fewer than half (47%) of the hospitals included links to their financial assistance applications.

- Two in five (40%) hospitals included summaries of their financial assistance policies

Mark Rukavina, Principal of Community Health Advisors, LLC, holds an MBA from Babson College and a BS from the University of Massachusetts in Amherst. He has more than 25 years of experience working on healthcare issues. In his current capacity he provides assistance on issues related to financial assistance, billing and collection, and community benefits requirements for tax-exempt healthcare providers. Mark has testified before US Congressional committees, and has published research and policy briefs.

Prior to establishing Community Health Advisors, Mark served as Executive Director of The Access Project a national, non-profit, research and advocacy organization and before that served as Program Director for a hospital/community partnership in Massachusetts under a national demonstration program sponsored by the American Hospital Association’s Health Research and Educational Trust.

Mark recently served on the Healthcare Financial Management Association/ACA International Medical Debt Advisory Task Force and the Healthcare Financial Management Association’s Price Transparency Task Force.

About State Collection Service, Inc.

Since 1949, State Collection Service has provided quality collection service to countless healthcare organizations.

Through experience and innovation, State Collection Service has grown to become a tremendously credible and nationally-recognized collection agency offering services from pre-registration to bad debt. It is upon the basis of ethical behavior and a dedication to integrity that each State Collection Service employee works to uphold the company’s vision – Partnerships for a Lifetime.

*This article first appeared in “A State Collection Service, Inc. Newsletter Volume 20, Issue 4, Fourth Quarter 2014”