There is a storm on the horizon and it is closer than many think. Between a 600% increase in high deductible health plans since 2005 (AHIP 2013 January Census) and the significant patient responsibility that accompanies Exchange-based plans (Healthcare Business Insights, Billing and Collections Benchmarks, January, 2012), providers are faced with challenges from the rise of the consumer as a payer.

Collection Fundamentals

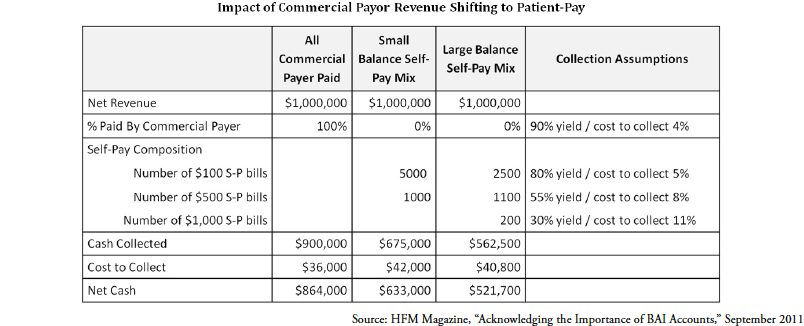

Patient responsibility represents a significant portion of outstanding A/R for hospitals and health systems. As reported in January 2012 by Healthcare Business Insights, self-pay A/R as a percentage of total outstanding A/R had reached 16.9 (Healthcare Business Insights, Billing and Collections Benchmarks, January, 2012). In addition, the cost to collect from a patient is twice the cost to collect from a commercial payer. The reality is, replacing commercial revenue with patient-pay revenue has significant impact to the bottom line.

As patient responsibility increases, the payer mix for providers will continue to change and put provider cash at risk. As shown in above, for every $1 million in net revenue that shifts from commercial payor to patient responsibility, providers could find themselves with a $200-300,000 reduction in net cash. While the specifics for any given provider will vary, there is material risk borne by providers as the payer mix shifts to patient-pay.

How to Prepare for the Challenge

Despite the gloomy outlook, all is not lost. Applying data science to patient pay can help providers prepare for and succeed in this new climate. It is important to recognize that not all accounts are created equal – roughly 30% of patient-pay follow-up activity has no cash value; roughly 30% of accounts drive over 80% of cash collections. Therein lies the opportunity – we should refocus the efforts that had no value and apply them to follow-up activity that will yield cash. If you knew an account would be worth a lot of cash by working it quickly, you would make it a priority. If you knew that a patient-pay account would pay in 10 days regardless of your effort, you would wait 15 days before checking the status. Predictive analytics can unlock patterns that would otherwise be missed, providing actionable insights to proactively improve the process and the outcome. This approach creates an analytically optimized revenue cycle, delivering net income impact.

Collection Performance Improvements

State Collection Service has put theory into practice. By integrating predictive analytics into their collection process, they have seen quarter-over-quarter increases to their average collection rate by 66% at one provider and 37% at another provider. These improvements have remained relatively consistent over time. Leveraging analytics to predict how a patient will pay, how much they will pay and how best to engage with them, coupled with the right workflows and their consistent use, has yielded dramatic gains in the amount of cash they collect for their clients.

Summary

Increases in patient responsibility from the Affordable Care Act and high deductible health plans will challenge many providers’ business office strategies. Patient-pay is a critical component of the payer mix. With opportunities to refocus efforts from low or no value follow-up, predictive analytics can provide a competitive advantage for providers and agencies alike. There are a range of ways to get started and to tailor the solution for a given provider. By creating an analytically optimized revenue cycle, organizations can significantly increase their cash collections and lower the cost to collect.

About the Author: David Franklin is one of the founders and COO of Connance, Inc. David is a member of the HFMA’s Medical Debt Task Force and is a frequent speaker on the topics of predictive analytics and revenue cycle process. Connance is a predictive analytics company helping hospitals and health systems transform their financial performance with an analytically optimized revenue cycle. Connance’s secure, cloud-based platform includes purpose-built analytics and advanced vendor management which deliver net income improvement.

About State Collection Service, Inc.

Since 1949, State Collection Service has provided quality collection service to countless healthcare organizations.

Through experience and innovation, State Collection Service has grown to become a tremendously credible and nationally-recognized collection agency offering services from pre-registration to bad debt. It is upon the basis of ethical behavior and a dedication to integrity that each State Collection Service employee works to uphold the company’s vision – Partnerships for a Lifetime.

*This article first appeared in “A State Collection Service, Inc. Newsletter Volume 20, Issue 2, Second Quarter 2014”